SticPay in Canada

SticPay official website

This international online payment gateway is relatively new. However, the multi-currency e-wallet has already received several awards from respected financial institutions.

What Is SticPay

SticPay is an e-wallet for secure money transactions. The company uses advanced protection features to keep users' funds safe. It's useful for online purchases, online casino deposits/withdrawals, etc., and has the best possible experience. Despite being so young, SticPay already has over $7 million in revenue. Let's find out more about the company and its services in Canada now.

SticPay official website homepage

Features of SticPay in Canada

Users can send and receive money within one minute. SticPay offers local currency settlement, borderless money transfer and services for online merchants. Besides, the multi-currency feature is fast and affordable.

How to Open a SticPay Account in Canada

Creating an account is fast and straightforward. Users only need to take a few minutes to bring together their payment details and get an e-wallet. To create an account, you'll have to provide an email and a phone number. The latter is essential for the SMS authentication stage. Immediately after that, one can deposit money via credit card, local bank transfer, cryptocurrencies.

Requirements

There are two main requirements for those who want to create an account. Firstly, a user must be over 18. Secondly, a person must not be a resident of any country where the company doesn't provide services.

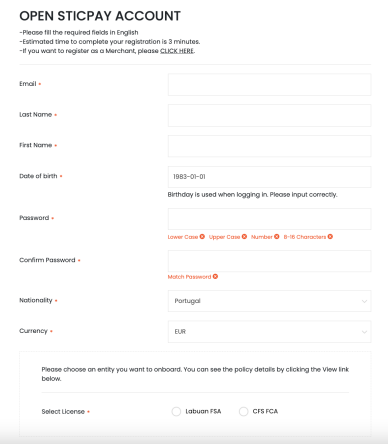

Registration process

To begin the registration process, a user must click on the "Sign Up" button at the top right corner. Then one must fill out the form and wait for one business day for the application to be approved.

SticPay registration form

SticPay Account Verification

To verify one's account, one must deliver two documents: ID and proof of address. However, users can start using the wallet without such verification until they spend over $250.

Recommended currency

Every user may choose from the list of options and pick USD, EUR, or GBP as a default currency.

Prepaid STIC Card - How to Use It

Most users can order STIC card. It allows using the money from the Stic Pay e-wallet anytime and anywhere. For instance, ATM withdrawal, shopping in stores, paying for services (in restaurants and other facilities), etc.

There is no need to worry about currency fluctuations when using this card because the conversion rates are applied during charging. All users get low exchange rates.

Card application process

To apply for a STICKPAY card, a user must be eligible and provide the following documents:

- Passport;

- Proof of legal existence;

- Proof of address.

One also has to add at least $110 to the account. Keep in mind that it takes about 2-3 weeks to get the card.

Daily and Monthly Limits

Action | Limit amount |

|---|---|

Daily Point of Sale Transactions | $ 2,000 |

Monthly Point of Sale Transactions | $ 9,500 |

Daily ATM Withdrawals | $ 5,000 |

Monthly ATM Withdrawals | $ 9,500 |

Fees

Withdrawal fee to STIC Card | 1.3% |

|---|---|

ATM Withdrawal | 1% |

Advantages of Using the Stic Card

STIC card offers numerous advantages. First of all, it's safe and convenient. Users may use the card for offline purchases and ATM withdrawals. Besides, the services are transparent as the cards are regulated by financial authorities. Finally, the instant charges immediately reflect the withdrawals in the online account.

SticPay Deposit Methods

The company has numerous deposit methods. The most common one is a bank wire transfer. Users can use both international and local banks to add money to the account.

It's equally easy to use MasterCard, Visa, and UnionPay to transfer money to the SticPay e-wallet.

In case you prefer to make cryptocurrency transactions, the company accepts Bitcoin and Litecoin.

How to Withdraw from SticPay

To complete a withdrawal, users must fill out the form and confirm the action. The form requires minimum information like the sum of withdrawal, the recipient, etc. However, before completing the transaction, one should pay attention to the fees. They differ based on the chosen withdrawal method. Everyone can choose between a bank transfer, ATM withdrawal and alternative means.

Bank transfer

When withdrawing money via a bank wire transfer, users will be charged 5% (during international transfers). Local bank wire transfers could have different fees that depend on the country.

Alternative payment means (NETELLER, Skrill, UnionPay)

Stic Pay also offers users to withdraw cash via UnionPay. The fee is 2% for every transaction. Among alternative options, users will also discover Bitcoin and Litecoin withdrawal methods.

Withdrawal from ATMs (STICPAY card)

This method is suitable only for users who own STICPAY cards. These withdrawals come with a 1.3% fee.

SticPay for Cryptocurrencies - Bitcoin, Litecoin, and Ethereum

Users who prefer cryptocurrencies can use three popular options. The company deals with Ethereum, Litecoin, and Bitcoin. It's convenient because these transactions are processed during weekends and holidays, too. If you are a merchant and wish to add cryptocurrencies to the payment options, Stic Pay will provide a QR code that buyers can scan to complete the purchase. Keep in mind that the fees differ (see the table below).

Payment procedure

A user must go to Crypto Wallet in MyPage, choose the cryptocurrency wallet, and fill out the request form (deposit or withdrawal). One can learn everything about cryptocurrency fund management by consulting the Support Team.

Fees

Cryptocurrency | Deposit fees | Withdrawal fees |

|---|---|---|

Ethereum | 1% | 1% |

Litecoin | 1% | 1% |

Bitcoin | 1% | .2% + $3 |

Besides, the fintech solution features a competitive 1.8% fee for processing cryptocurrency transactions.

Comparison with Other Digital Wallets in Canada

To give you a more comprehensive image of this e-wallet, let's compare it with other popular solutions in the region.

FACTOR | PAYEER | ECOPAYZ | PERFECT MONEY | SKRILL | NETELLER | WEBMONEY | |

Base Currency | USD | USD | EUR | No data | EUR | EUR | No data |

Account Currencies | 23 fiat currency 3 crypto currency | 3 fiat currency 3 crypto currency | 53 currencies | 2 fiat currency + 1 crypto currency + Gold | 38 (35 fiat and 3 crypto) | 36 (28 fiat and 8 crypto) | RUB, VND, KZT, UZS, EUR, BYR |

Deposit Method | Bank wire (Local and International), Visa/Mastercard, China Union Pay, Cryptocurrencies | Qiwi, Yandex Money, Advcash, Bitcoin | Visa Credit Card, American Express, Dragon Pay Account, Crypto currency, PH Available Method | Bank transfer, Maestro, Visa, Mastercard, American Express, JCB, Paysoft card, Bitcoin, Neteller, Fast bank transfer, Buko, Klarna, Trustev, Swift | Mastercard Credit and Debit, Maestro, Bitcoin/Bitcoin Cash, Visa Credit, Debit and Electron, Skrill | Visa/Mastercard, Bank transfer, Cash In Terminals Bank transfer | |

Withdrawal Method | Bank wire international, Local Bank wire, China Union Pay, Cryptocurrencies | Qiwi, Yandex Money, Advcash, Payeer, BTC, ETH, BCH, LTC, DASH, USDT, VISA/MASTER CARD | Bank wire, ecoCards for EEA country only | Bank wire, Cash Deposit, e-Voucher, Certified Partners, Bitcoin, Credit Exchange | Swift, Local bank wire, Visa, Prepaid card at ATM | Bank transfer, Mamber wire, Merchant site, Money Trasfer | Visa/Mastercard, Bank transfer, Uni Stream |

Visa/Master Cards Money in | 3.85% | 4.9%+5S | 2.9% Visa only | No data | 100% | 25% | 2% |

China UnionPay for Chinese clients | Yes | NO | NOT AVAILABLE | NO | NO | NO | NO |

Duplicate Account | Yes | No data | NO | NO | NO | NO | NO |

Prepaid Card | YES | NO | EEA Country only | NO | Skrill prepaid Master Card | Neteller + prepaid card and Neteller virtual card | NO |

Inactivity Fee | YES | NO | 150 EUR per month if you have not accessed your Account in 12 months. But this only applies if you have positive balance | No data | No data | $5 | No data |

Language in use | 17 | 5 | 12 | 23 | 14 | 18 | 5 |

Internal Transfer Fee | 1% | 0.02$/EUR | 1% (min 0.50 EUR) | Premium account 0.5%, Verified account 0.5%, Unverified account 1,99% | 1,45% Min. Fee: GBP 0.43 | 1,45% (Minimum 0.50 USD) | 1% |

SticPay vs Neteller

| STICPAY | Neteller |

Base Currency | USD | EUR |

Deposit Methods | Visa, Mastercard, UnionPay China, Cryptocurrency, Local and International Bank wire | Visa, Bitcoin, Local Bank transfer and Payment Services |

Withdrawal Methods | Local and International Bank wire, UnionPay China, Prepaid STIC Card, Cryptocurrency | Bank transfer, Prepaid Card |

Visa/MasterCard Deposit Fees | 3.85% | 2.5% |

Internal Client to Client Transfer Fees | 1% (max. $35) | 1.45% (min. $0.50) |

Local Bank Wire Withdrawal Fees | 1-2% (varies by country) | $10 |

Inactivity Fee | No | $5/month after 12 months of inactivity |

Multi-Currency Account | Yes | No |

Currencies Supported | 33 Local Currencies + 4 Cryptocurrencies | 27 |

Cryptocurrency Funding and Withdrawals | Bitcoin (BTC), Ethereum (ETH), Uitecoin (LTH), Tether (USDT) for both deposits and withdrawals | Bitcoin (BTC) only for deposits |

SticPay vs EcoPayz

| STICPAY | EcoPayz |

Base Currency | USD | EUR |

Deposit Methods | Visa, MasterCard, UnionPay China, Cryptocurrency, International and Local Bank Wire | Credit and Debit Cards, International Bank Wire, Local Deposit Options |

Withdrawal Methods | International and Local Bank Wire, UnionPay China, Prepaid STIC Card, Cryptocurrency | International Bank Wire, Prepaid Card |

Visa/MasterCard Deposit Fees | 3.85% | 169-6.00% + $0.30 |

1% (max $35) | 1.50% (min. $0.60) | |

Local Bank Wire Withdrawal Fees | 1-2% (varies by country) | Not Available |

Inactivity Fee | No | $1.79/month after 12 months of inactivity |

Multi-Currency Account | Yes | Only for Silver Members |

Currencies Supported | 33 Local Currencies + 4 Cryptocurrencies | 45 |

Cryptocurrency Funding | Bitcoin (BTC), Ethereum (ETH), Litecoin (LTH), Tether (USDT) for both deposits and withdrawals | Not supported |

SticPay vs Skrill

| STICPAY | Skrill |

Base Currency | USD | EUR |

Deposit Methods | Visa, MasterCard, UnionPay China, Cryptocurrency, International and Local Bank Wire | Credit and Debit Cards, Local Bank Transfers and Payment Services, Bitcoin |

Withdrawal Methods | International and Local Bank Wire, UnionPay China, Prepaid STIC Card, Cryptocurrency | Local and international Bank Transfers, Visa, Prepaid Card |

Visa/MasterCard Deposit Fees | 3.85% | 1% |

Internal Client to Client Transfer Fees | 1% (max. $35) | 1.45% (min. 0.50 EUR) |

Local Bank Wire Withdrawal Fees | 1-2% (varies by country) | 5.50 EUR |

Inactivity Fee | No | 5 EUR/month after 12 months of inactivity |

Multi-Currency Account | Yes | No |

Currencies Supported | 33 Local Currencies + 4 Cryptocurrencies | 40 |

Cryptoourrency Funding and withdrawals | Bitcoin (BTC), Ethereum (ETH), Litecoin (LTH), Tether (USDT) for both deposits and withdrawals | Bitcoin (BTC) only for deposits |

SticPay vs iDebit

FAQ

How can I close my SticPay account online?

To close the account, a user must notify the Support Team.

Why can I not deposit funds?

Users must verify the account by submitting an ID and proof of address before making any deposits.

How do I make a Bitcoin deposit?

To deposit Bitcoins, one must go to the Deposit page, select Bitcoin, and fill out the form to complete the transaction.

What countries can a bank transfer be made to?

The company offers its services to most countries except for Cuba, Sudan, Syria, North Korea, and listed / relevant parties of CUNSCSL.