Overview of the GiroPay in Canada

GiroPay official site

Since GiroPay was launched in 2006, the company has been steadily growing and expanding its impact. Nowadays, users from various countries, including Canada, can use this online payment method.

How GiroPay Works in Canada

It's significant to understand that GiroPay is a German company that operates through German bank accounts. To use this payment method for Canadian casinos, one has to have a German bank account or get it while being abroad. It is the only case when a Canadian user can use this method for gambling.

How GiroPay Works

Creating GiroPay

As it was briefly mentioned earlier, it's essential to have a German bank account to use GiroPay. A person must also be over 18 years old. The rest is simple. One only needs to connect a bank account to GiroPay. Over 80% of German banks work with this payment method, which is very convenient.

How to Make a Payment

To make a payment, the customer must select the bank account and connect it to GiroPay. After that, one must log in, access the banking data, and approve the bill via the pre-filled GiroPay transfer.

Users benefit from secure ID and other security methods. Consequently, they can easily use e-money instead of cash to pay for goods and services they want. Every transaction requires an identification so that no one else could use this data.

Unfortunately, GiroPay doesn't offer exchange services, bonuses, or other perks. However, the system allows making payments of any denominations.

Bank Selection

The first step is to pick a bank that works with GiroPay. There are over 1500. Since the company works only as an intermediary, one has to own a German bank account to use GiroPay in Canada. It's essential to remember that the company operates with euros only. No cryptocurrency or other country's currencies.

Log in with your online banking credentials

After selecting the needed bank, a user must log into a bank account. A user can perform this action using the desktop or mobile application (app for Android or app for iPhone). At this point, one should also make sure the action is within the budget.

Payment authorization

The system will redirect a user to the pre-filled transaction page, where the last step is required, a user must verify the payment using the provided details. It could be a PIN or a validation code. From that moment, there'll be a pending deposit on the merchant list. As soon as it's processed, both parties receive a notification.

How to deposit and withdraw money

Deposits are very simple and straightforward. A user must log in to the account on the website (where the deposit must be transferred), click on deposit, choose the sum, and verify the action. The latter requires an email, GiroPay account number, and bank routing number.

GiroPay is not an international bank. That's why users can't get a virtual card, a prepaid card, a traditional MasterCard, or any sort of voucher. They pay via virtual money.

Depositing money

Depositing money into GiroPay is an easy and fast process, meaning those that do have a German bank account that is set up for online banking can get in on the action quickly through the GiroPay method. The entire GiroPay depositing process is so easy that it takes a matter of minutes to get funds from your bank account to the sportsbook.

The risk of fraud, scams, or unrecognized payments is low because the customer must authenticate the payment with their bank. As a result, there are no disputes that turn into chargebacks or refunds. Please ask the bank's customer service whether it charges additional account-management fees for the use of GiroPay.

Withdrawing and limits

GiroPay is currently available for pay-ins only, with no cash out services. Yet, the main fees and limits are as follows.

Deposit limit | 5000 EUR |

|---|---|

Card limits | differ based on the card and bank |

Charging fees | 0.9-1.2% + 0.08 EUR per transaction |

Using GiroPay (as a customer) | free |

Banks accepting GiroPay payments

The majority of German banks support GiroPay as a payment gateway. It implies over 80%, i.e. 1500+ to choose from various chains. However, you may discover more information on the current selection by using the official website.

Additional Security

With GiroPay, all payments are completely safe. The system uses high standards of security and data protection by encrypting personal data transfer. GiroPay redirects customers to their website to authenticate payment, and there is an immediate notification about the success or failure of a payment.

Depending on the bank, users might also need to confirm transactions using a 2-factor authentication or a PIN.

Age verification

To perform age verification, all you need to do now is enter a TAN. Both you and the merchant will receive confirmation that age verification was successful.

Verification

To perform account verification, a user must log in and enter a TAN. The successful verification is proved by a confirmation message.

System charges and fees

A start-up fee | 100 EUR (for merchants) |

|---|---|

A monthly fee | 10 EUR (for merchants) |

Commission fee | 0.6 - 1.2% per transaction (for merchants) |

Commission fee | 0 (for customers, bank fees might apply separately) |

ATM withdrawal | 0 (the company doesn't offer such pay-outs) |

GiroPay Benefits for Canadian users

All Canadian users experience the following benefits when using GiroPay Canada:

- Trusted payment method;

- No need to have a credit card or debit card;

- Convenient, reliable, simple;

- Advanced security;

- Access to more services;

- Easy deposits in online casinos for gamblers;

- Convenient online shopping.

Comparison with other payment methods

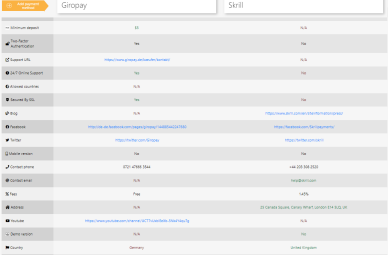

To have a better understanding of the payment method and its benefits, let's compare GiroPay to other well-known options, namely Skrill, QIWI, Neteller, Paysafecard, and EcoPayz.

GiroPay vs Skrill

Comparison of GiroPay vs Skrill

- GiroPay vs QIWI

- GiroPay vs Neteller

- GiroPay vs Paysafecard

- GiroPay vs EcoPayz

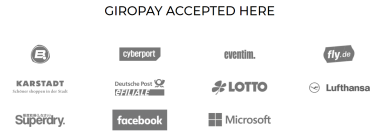

Where can I use GiroPay?

- Paying in an online shop

Over 40 million users use this payment method to pay for goods and services online. Aside from that, lots of companies like Lufthansa, Deutsche Post/DHL, and CTS Eventim accept this payment method.

- International transactions

A user may enable some international transactions, but the system mainly works within the country.

- Online Gambling and Casino

Companies that accept GiroPay

FAQ

How does GiroPay work?

GiroPay works similar to other payment systems. Users can use their bank account to complete secure online payments in real-time and with several clicks.

Where can I pay with GiroPay?

Since GiroPay is an interbank system, users can use it to pay in online stores, gambling sites, and any other websites that accept this payment method.

What is GiroPay-ID?

GiroPay-ID is a verification system that allows customers to prove that they are of legal age (age verification) or account details (account verification) to online providers.

What are the alternatives to GiroPay?

If you prefer to use other payment methods, you can try Skrill, QIWI, Neteller, Paysafecard, and EcoPayz. They offer services similar to GiroPay.

What banks are accepted by GiroPay?

Over 80% of German banks accept GiroPay because the company works with German bank accounts only.