Phoenix Group

Phoenix Group is one of the world's largest pension insurance companies. Phoenix Group manages assets worth more than £290 billion and has over 14 million customers.

Company | Phoenix Group |

Year of establishment | 1857 |

Field of activity | Insurance |

Stock exchange listing | PHNX |

Number of employees | 6,600 |

Headquarters | Juxon House, 100 Saint Paul's Churchyard, London, EC4M 8BU |

Main markets | United Kingdom, Germany, Ireland |

Assets under management | £287,44 billion |

History

Who owns Phoenix Group

The company's history dates back to 1782. The Phoenix Group was formed as a result of the merger of several companies operating in the insurance sector. The company was created through the merger of Phoenix Assurance, London Life, British Workman's Association, and National Provident Institution (NPI).

From 1990 to 2003, Phoenix Group was part of AMP Limited (a financial group of companies from Australia). In 2005, the company left this group. At that time, the company was called Pearl Group.

In 2010, the name was changed to Phoenix Group. Between 2008 and 2020, the company acquired several other companies (Resolution Life, Abbey Life, Standard Life Aberdeen, ReAssure). This made it more influential in the insurance services market.

Currently, Phoenix Group has over 14 million customers. The company's main markets are the United Kingdom, Ireland and Germany.

What does Phoenix Group do?

Phoenix Group Holdings

The main focus of Phoenix Group Holdings is pension insurance. The company provides its services in the UK, Ireland, Germany and several other European countries.

In addition to pension insurance, Phoenix Company offers its clients insurance in other areas, including cyber risk insurance, commercial motor insurance, property insurance, health and life insurance, and rented property insurance.

Investor relations

Phoenix Group has paid dividends regularly for more than 15 years. Therefore, the company's relationship with investors can be described as good. Among the largest shareholders of Phoenix Group are the following investment funds:

- The Vanguard Group, Inc. — 3.6% of shares;

- UBS Asset Management AG — 2.56% of shares;

- Janus Henderson Group plc — 2.42% of shares;

Phoenix Group is a public company, so every year it publishes a report containing all the results of its activities.

Who is part of Phoenix Group?

Who is part of Phoenix Group

The Phoenix Group comprises a number of divisions, each of which specialises in its own area:

- UK Heritage. This division manages pension funds in the United Kingdom.

- Europe. This division manages open and closed pension funds in Europe.

- ReAssure. This division manages closed insurance funds.

- UK Open. Serves life insurance policies in the United Kingdom.

- Management Services. Provides insurance fund management services.

Phoenix Group annual report and results

We’re Phoenix Group

The published report, based on the results for 2024, contains the following indicators:

Revenue | £10,74 billion |

Net profit | £0,81 billion |

Earnings per share | £0,021 |

Assets under management | £287,44 billion |

Phoenix Group Share Price

Phoenix Group share price

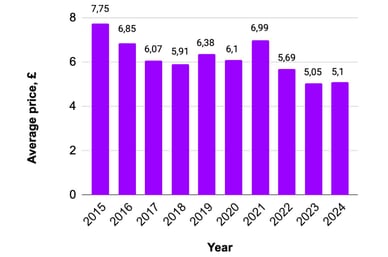

The price of Phoenix Group (phnx) shares over the last 10 years:

Year | Maximum value £ | Minimum value £ | Average price £ |

|---|---|---|---|

2024 | 5,73 | 4,47 | 5,10 |

2023 | 6,06 | 4,03 | 5,05 |

2022 | 6,92 | 4,46 | 5,69 |

2021 | 7,62 | 6,36 | 6,99 |

2020 | 6,76 | 5,45 | 6,10 |

2019 | 7,44 | 5,32 | 6,38 |

2018 | 6,50 | 5,32 | 5,91 |

2017 | 6,48 | 5,65 | 6,07 |

2016 | 8,05 | 5,65 | 6,85 |

2015 | 8,05 | 7,45 | 7,75 |

Phoenix Group share price forecast

According to leading analysts, the average price of Phoenix Group shares is expected to be 668 GBX over the next 12 months, with a minimum price of 550 GBX and a maximum price of 850 GBX.

These estimates suggest that the share price is expected to fall by approximately 7% over the next 12 months. There are more optimistic estimates, for example, analysts at the Financial Times / Investors Chronicle expect the share price to rise by 4.1% over the next 12 months.

Based on this, the following options can be identified:

- Conservative strategy. Expected share price range – approximately 660–680 GBX, upside potential of up to 4%.

- Risky option. Probable increase in value to 850 GBX (bullish scenario), but with low probability.

- Negative scenario. Decline in value to 600 GBX if financial results or the macro environment deteriorate.

It is important to monitor the next financial report that the company will release. It is also worth paying attention to news regarding possible changes in interest rates. In the event of a change in interest rates, estimates of possible share prices may change significantly.

Phoenix Group

Phoenix Group dividends

Over the past 10 years, the company has paid dividends twice a year. This usually took place in the middle and at the end of the year. Dividend results for the last 5 years:

Date | Dividends, GBX | Income |

|---|---|---|

21.05.2025 | 27,35 | 9,42% |

31.10.2024 | 26,65 | 9,59% |

22.05.2024 | 26,65 | 9,71% |

23.10.2023 | 26,00 | 10,24% |

10.05.2023 | 26,00 | 8,96% |

12.09.2022 | 24,80 | 7,89% |

09.05.2022 | 24,80 | 7,71% |

03.09.2021 | 24,10 | 7,22% |

18.05.2021 | 24,10 | 6,47% |

04.09.2020 | 23,40 | 6,49% |

19.05.2020 | 23,40 | 7,83% |

Frequently asked questions

When does Phoenix Group pay dividends?

Dividends are paid twice a year, in the middle of the year and at the end of the year. The next dividend payment is scheduled for 30 October 2025.

Who owns Phoenix Group?

Phoenix Group's owners include a large number of investment funds and private shareholders. The largest stakes are held by: The Vanguard Group, Inc. — 3.6%, UBS Asset Management AG — 2.56%, Janus Henderson Group plc — 2.42%.

Where is Phoenix Group headquarters?

The company's headquarters are located in London, at Juxon House, 100 Saint Paul's Churchyard, London, EC4M 8BU.

Why is Phoenix Group share price falling?

The fall in share prices is due to investors believing that the company's solvency may decline.

Should i buy Phoenix Group shares?

Some analysts (MarketBeat) expect the value of the company's shares to fall by approximately 7% over the next 12 months. Other analysts believe that the company's share price will rise (Financial Times/Investors Chronicle, ValueInvesting.io) by approximately 4%.