Overview of Klarna in Canada

Klarna is a financial technology company whose main aim is to provide payment solutions for online purchasing. In 2019, Klarna was introduced in Canada, allowing international and Canadian merchants to offer new payment methods to their customers in Canada while increasing their sales.

Is Klarna available in Canada

Yes, Klana is available in Canada. Klarna has partnered with Canadian Merchants and other international retailers to offer customers based in Canada many flexible payment options that allow them to make purchases whenever they want to. To find out more about Klarna Canada keep reading this review.

What are Klarna payment options

Klarna offers the following payment options to customers:

- Pay in 30 days.

- Financing.

- Installments

Do you need to buy an online product and you don't have money saved or you are new to credit and you do not qualify for a card yet or have a low credit limit? Klarna may just be the right option for you.

How does Klarna work

Pay in 30 days

Pay in 30 days is one of the options of payment Klarna gives its customers when they are checking out. How does it work? Place an order and pay for it in 30 days no later. Customers can choose to return the product within the 30 days or keep it and pay for it. Payment must be done within 30 days.

Financing

The financing option works like a credit card, if a customer qualifies after making an application they can finance their purchases over 6 to 36 months. What does this mean? Customers are provided a loan to buy products online after successful application completion with a credit check. The financing terms can be in 3 forms:

- Monthly payment

- Planned payment

- Full payment.

If the balance is paid in full before the expiry date no interest is paid.

Installments

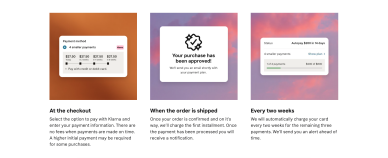

The installment option means the customer can pay in parts until the payment is complete. How does it work? The total checkout amount is divided into four interest-free parts. The first part is to be paid when the order is shipped and it covers about 25% of the purchase, while the remaining three parts are automatically charged during a two-week interval. No interest applies except in a case where the credit card charged by Klarna has a balance on it.

How to pay with Klarna

Klarna Canada is a safe payment system, you can use it to pay for purchases online and instore easily. To pay with Klarna, there are very simple steps to follow:

- Get the app

- Identity verification

- Purchase through the app.

Get the Klarna App

There is a Klarna app available for customers. The first step when paying with the app is to download the Klarna app. The app is available on android and iPhone, to download simply go to Apple and Google app stores and download it.

Verify your identity

After downloading the app the next step is registration or log in if you have already registered on the website. Klarna will need you to verify your ID. Verification of ID is a very necessary step for customer Identification, ID theft is becoming rampant and Klarna's main goal is to protect the interest of their customers and secure ID.

Make a purchase through the Klarna app

After verification of ID, you should link your credit card or bank account to your account and carry on with your shopping. To navigate the app when shopping here are the steps to follow:

- Select "My Klarna"

- Select what you would like to purchase.

- Follow the Klarna checkout instructions.

Each purchase made goes through an approval process where Klarna checks your credit.

What type of cards Klarna accepts

Klarna card

Right now Klarna accepts all major debit cards and credit cards including VisaCard, MasterCard, American Express, Discover, Maestro, etc. It is important to note that prepaid cards are not among the many cards that Klarna accepts. You can link any of these card types to your account and use them when checking out.

Card requirement

There are certain card requirements when using the Klarna payment option.

- The credit and debit cards should be valid.

- The credit card or bank account linked to your account should be active.

- Fund should be made available in your card before the due date of payment.

- The card limit of the card linked to your account shouldn't be exceeded.

There is an age limit when it comes to Klarna financing, customers have to be at least 18 years old to be eligible.

Currencies accepted by Klarna

The following currencies are accepted in Klarna checkout: USD, Euro, Australian Dollars, British Pounds, Swiss Franc, Candian Dollars, Swedish Krona, Norwegian Krone and Danish Krone. Cryptocurrencies like bitcoin can also be used.

All transfer fees and other commissions

When using Klarna there are certain transfer fees and commissions that apply in different situations.

Payment methods

Payment Option | Transfer fee | Variable fee per transaction |

|---|---|---|

4 Installment | $0.30 | 5.99% |

Financing | $0.30 | 3.29% |

Pay in 30 days | $0.30 | 5.99% |

Instant shopping

Monthly product fee | Transfer fee | Variable fee per transaction | |

|---|---|---|---|

Onsite | $30.00 | $0.30 | 3.29% |

Offsite | $30.00 | $0.30 | 3.79% |

How to use Klarna shopping loans

Klarna split payment

Klarna allows their customers to shop online with shopping loans. How to use these loans:

- Select "Pay later" with Financing.

- Choose your preferred payment method.

- Complete a 4-step credit application.

- The shopping loan is issued instantly on approval.

- Pay for your purchases now.

As soon as the order is shipped Klarna sends you a payment schedule and adds your purchase to your balance.

Pros and Cons of using Klarna payments

When using Klarna Canada or any other financial company, it is essential to know the pros and cons.

Pros

- Klarna allows customers to buy now and pay later.

- Membership or annual fees are not required.

- Klarna does not require a minimum credit score.

- Gives customers opportunity to fund major purchases

- Rapid transfer of funds.

- Great customer service and support is available.

Shopping with Klarna

Cons

- The option of financing can affect the customers credit.

- Prepaid cards are not allowed.

- Late fees apply when payment is defaulted.

- Return payment fees apply.

Canadian merchants accepting Klarna

Klarna for business

Different Canadian Merchants from different categories like fashion, sporting goods, cosmetics, electronics, home furniture, etc. use Klarna. Merchants who have partnered with Klarna have seen growth in customer traffic, also an increase in conversion rates. Here is a list of some of them:

- Hudson's Bay

- Samsung

- Sephora

- Sail

- Dynamite

- The source

- eBay

- Endy

- Wayfair

- Shein

- Garage

- Sleep country

- Article

- Steve Madden

- Casper

- Douglas Bed

- Giant Bicycle Canada

- Beautycounter

- Bestseller Canada

- Casper

- Fitness Town

- Vera Moda

- Dyson

- Bowflex

- Luxury Hair

- Logan & Cove

This is just a shortlist of some Canadian merchants there are many more affiliated with Klarna.

Comparison to other payment methods

There are severe other online payment methods that exist and it is necessary to know how Klarna compares with other payment plans.

Klarna vs Skrill

The table below compares Klarna and the very well known Skrill

Klarna vs Muchbetter

Muchbetter and Klarna are compared below

Klarna vs Neteller

Neteller is an e-money transfer service and it is compared with Klarna below.

Klarna vs Paysafecard

Paysafecard is also an online payment method that has similarities and differences with Klarna.

Klarna vs EcoPayz

Lastly, we are going to be comparing Klarna to EcoPayz, another payment method.

Where can I use Klarna

Paying in an online shop with Klarna

It is possible to use Klarna Pay for various types of transactions including:

- Paying in an online shop - you can use Klarna to make payments on online shopping sites via Klarna app or the partnered stores website.

- Online Payments - with Klarna you can make bank transfers and track your transfers too when complete.

- Online Gambling and Casino - A lot of online gambling sites and Casinos also accept Klarna as a payment method.

Klarna bank is now one of the largest banks in Europe, catering to millions of customers and merchants around the globe. Many online retailers offer payment through Klarna, a financial option that allows you make your purchases or transfers with little or no hassle.

FAQ

Is Klarna available in Canada?

Yes, Klarna financing company has been available in Canada since 2019. Canadians can now shop on their favorite shopping sites with favorable payment options. Canadian merchants have also partnered with Klarna to offer better services to customers.

How does Klarna work?

Here is how Klarna works:

- Register an account, link a credit card or bank account.

- Choose what you want to purchase

- Select a payments option and a preferred payment method

- Your purchase is made instantly.

Where can I pay with Klarna?

Transactions you make with Klarna:

- Paying for shopping online

- Bank transfers

- Payment in online casinos and betting sites

What is Klarna Payment?

Klarna Payment is the payment made using Klarna. With Klarna customers can make payment using severe comfortable payment options which includes Pay in 30 days, installment payment and financing plans.

How do I make purchases through the Klarna app?

These are the steps to follow:

- Download the app.

- Log in to your account.

- Verify your ID

- Click on the option of “My Klarna” and select what you will be paying for.

- Complete the checkout process

Klarna is a fast growing payment solution that offers convenience to both the retailers and their customers.