Synthomer

Synthomer is a British chemical manufacturing company with a history spanning more than 150 years. The company is listed on the London Stock Exchange. It was formerly known as Andrew Yule & Co.

Year of foundation | 1863 |

Country | United Kingdom |

Chief Executive Officer | Michael Willome |

Products | Adhesives, coatings, cementitious systems, health protection materials, adhesive additives |

Number of employees | 2,146 people |

Revenue | $2.49 billion |

Share price (SYNTS) | $67.2 |

Key employees | Michael Willome, Lily Liu, Lee Hau Hian, Caroline Johnston |

Synthomer Key employees

History of Synthomer

Synthomer is considered to have been founded in 1863, when English businessman Andrew Yule established a trading house in Calcutta called Andrew Yule & Co. At the same time, his brother George Yule established a company in London that acted as a representative office for Andrew Yule & Co.

The company's activities were quite diverse, ranging from mechanical engineering and electrical engineering to the cultivation and supply of tea and jute. During the British Empire era, it was a large conglomerate that manufactured and supplied goods not only to the United Kingdom but also to many other countries.

In 1919, the company was acquired by the large American banking group J.P. Morgan & Co. As a result, the company's legal status was changed from a partnership to a private company, a limited liability company.

In 1920, the company changed its name to Yule, Catto & Company Ltd. As a result of tax increases, the devaluation of the Indian rupee and other legal and economic changes, the company's shares were sold to the Indian government in 1969.

In 1980, Yule, Catto & Company Ltd. acquired Revertex Chemicals, a chemical manufacturing company. As a result, the management of Yule, Catto & Company Ltd began to transform the company into an international corporation operating in the field of chemical and building materials production.

The company changed its name to Synthomer in 2012, as a significant number of the company's divisions were already operating under that name by that time.

In 2019, Synthomer acquired OMNOVA Solutions for $824 million. In 2021, adhesive manufacturer Eastman Chemical also joined the Synthomer group of companies. The deal was worth $1 billion.

Currently, the Synthomer group of companies operates in three main areas: polymer production, specialty chemicals and pharmaceutical chemicals.

Synthomer Headquarters

Synthomer headquarters

Synthomer's headquarters are located in the British capital, London, at the following address: 45 Pall Mall, SWIY 5JG. The company's telephone number is +44 1279 436 211.

Who owns Synthomer?

Who owns Synthomer?

None of the company's owners hold more than 50% of the shares. The largest shareholders in Synthomer are:

- Kuala Lumpur Kepong Berhad – 26.91% of shares.

- Artemis Investment Management LLP – 5.4% of shares.

- UBS Asset Management AG – 4.82% of shares.

- Greater Manchester Pension Fund – 4.82% of shares.

- Schroder Investment Management Limited – 4.16% of shares.

- All other owners of the group of companies hold less than 4% of shares.

Synthomer: investor relations

Synthomer - Corporate video

Synthomer is a public company that regularly publishes financial reports on its commercial activities. Therefore, investors are provided with detailed information about the company's financial performance.

Synthomer used to pay dividends to its shareholders on a regular basis. In recent years, this situation has changed. Synthomer will not pay dividends in 2023, 2024 and 2025. This is due to the deterioration of the company's financial position.

Synthomer's management plans to return to the practice of paying dividends once the company's financial performance improves.

What does Synthomer do?

Synthomer plc

The main activity of the Synthomer group of companies is the production of specialised chemical products, including:

- The production, development and sale of resins and special additives for adhesive compounds. The company produces a considerable number of different types of resin additives for adhesives, as well as styrene-butadiene rubber. Styrene-butadiene rubber is used in the production of coated paper, which is used for packaging, pillows, mattresses and other products.

- Production of nitrile-butadiene latex. This material is used in the production of various products used in the medical field (gloves, catheters and others).

- Development of coatings for various products. The company develops and manufactures many products used for coatings, for example, for metal, masonry, fire protection and others.

Synthomer's main areas of activity are construction, paper, healthcare, textiles and coatings.

Synthomer Annual Report and Results

Synthomer is a public company, so it regularly publishes reports on its financial activities. The 2024 report presented the following performance indicators for the company:

Indicator | Result |

|---|---|

Revenue | £1,986 million, an increase of 5.1% compared to 2023 |

EBITDA | £146.6 million, an increase of 9.2% compared to 2023 |

Operating profit | £50.4 million, up 54.5% compared to 2023 |

Total loss | £7.2 million, compared to a loss of £31.1 million in 2023 |

EPS | -£2.5 million, EPS in 2023 was -£31.1 million |

Synthomer shares

Recently, the value of Synthomer shares has fallen significantly due to increased volatility in the end products manufactured by Synthomer. This situation was caused by an increase in tariffs.

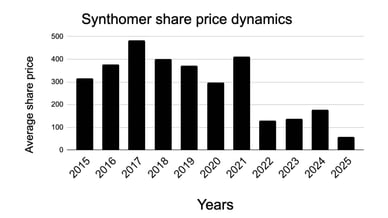

Synthomer share price dynamics

Average share price by year (in pounds sterling):

Year | Average cost, GBP |

|---|---|

2025 | 57.2 |

2024 | 179 |

2023 | 137.4 |

2022 | 128.5 |

2021 | 411.7 |

2020 | 298 |

2019 | 372.6 |

2018 | 401.8 |

2017 | 483.2 |

2016 | 376.9 |

2015 | 314.8 |

Synthomer dividends

As of 2025, the Synthomer group of companies does not yet pay dividends to shareholders. The company's management admits that in 2026, the company's policy in this regard may change and dividends will be paid to its shareholders.

The decision not to pay dividends is due to the fact that the company ended 2024 with a loss of £7.2 million. It is worth noting that the loss in 2023 was higher, amounting to £31.1 million. If the company's financial position improves, dividends will likely be paid to investors.

Frequently asked questions

Why is Synthomer's share price falling?

In August 2025, Synthomer's shares fell due to increased volatility in demand for the company's products. The increase in volatility was caused by higher tariffs.

Who owns Synthomer?

Synthomer is a public company listed on the London Stock Exchange. The company has many owners, with the following investment funds being the largest shareholders: Kuala Lumpur Kepong Berhad, Artemis Investment Management LLP, and UBS Asset Management AG.

What does Synthomer do?

Synthomer's main activities are the production and development of resins for adhesive compounds, the production of nitrile butadiene latex, and the creation of coatings for various products.