Survey: 39% have a side hustle, and 44% believe they’ll always need one — Bankrate study

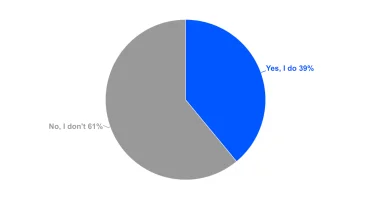

From delivering takeout and walking dogs to building a new business and consulting, Americans are working hard outside their full-time job. Nearly two in five (39 percent) of U.S. adults have a side hustle, according to a new Bankrate survey.

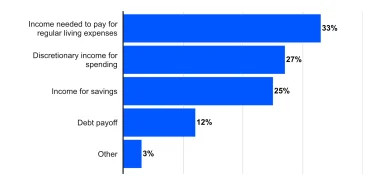

Side hustles are a way for people to earn extra money aside from their regular income, and for many Americans, side hustle income isn’t for fun money. Amid inflation and the increasing likelihood of an economic downturn, people need their side income to pay their everyday bills. One in three (33 percent) U.S. adults with a side hustle say they need the money for regular living expenses, far more than those who use it for discretionary spending (27 percent).

As side hustles become an increasingly vital source of income for many Americans, here’s who is putting in the extra work — and how much they’re making in the process.

Bankrate’s key side hustle insights

- Side hustles are bringing in hundreds of dollars a month for the average person. U.S. adults with a side hustle make $810 per month on average.

- Side hustle income is necessary for many people. 33% of side hustlers say they need the extra money for day-to-day living expenses. In comparison, 27% of people say they need it for discretionary spending money, 25% need it for savings and 12% need it to repay debt.

- Side hustling is more commonly necessary for lower-income workers. 42% of side hustlers with a household income under $50,000 a year say they need side hustle income for day-to-day expenses, more than any other income bracket.

- Side hustles may not be just a temporary solution for some Americans. 28% of those with a side hustle believe they’ll always need one to make ends meet.

Half of millennials and more than half of Gen Zers have a side hustle in 2023

Nearly two in five (39 percent) U.S. adults have a side hustle, according to Bankrate, meaning they earn money outside of their primary job, money from a family member, trust fund or any other main source of income.

Side hustles are more popular among younger Americans, as 53 percent of Gen Zers (ages 18-26) and 50 percent of millennials (ages 27-42) told Bankrate they earn extra income on the side.

We asked: Other than your main source of income, do you, personally, do anything to earn extra income on the side (i.e., a side hustle)?

Generational differences: part-time work is significantly more common among young people — Gen Z: 53%, millennials: 50%

Less than one-quarter, or 24 percent, of baby boomers (ages 59-77) say they have a side hustle, the smallest percentage of any generation. Slightly more, or 40 percent, of Gen Xers (ages 43-58) say they have a side hustle.

Along gender lines, men are most likely to have a side hustle, with 43 percent of men saying they earn money on the side compared to 35 percent of women.

The gap between annual income brackets is smaller than other demographic comparisons, but generally, those with a household income over $100,000 are most likely to have a side hustle:

- $100,000 and over: 45 percent

- Between $80,000 and $99,999: 35 percent

- Between $50,000 and $79,999: 39 percent

- Under $50,000: 40 percent

Americans make an average of $810 per month from their side hustle

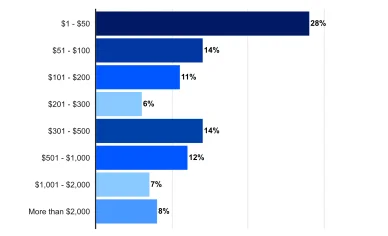

It’s possible to bring in hundreds of dollars a month through a side gig: The average person with a side hustle makes $810 a month from that extra work, according to Bankrate.

Most commonly, however, those with a side hustle make very little: 28 percent of people with a side hustle only make $1 to $50 a month.

We asked: On average, how much income would you say you earn in a month from your side hustle?

Money: average income from part-time work is about $810 per month; however, many people earn small amounts

Another 14 percent of people receive either between $51 and $100 a month. Only 15 percent of side hustlers make more than $1,000 a month.

Not only do more men have a side hustle, but they also typically make more, bringing in an average of $989 a month compared to $603 a month for women.

Keeping within the trend of younger Americans leading the side hustle workforce, millennials tend to make far more from their side hustle, on average, than other generations:

- Millennials: $1,022 a month

- Gen Z: $753 a month

- Gen X: $670 a month

- Baby boomers: $646 a month

1 in 3 people with a side hustle need the funds for day-to-day expenses

These side hustles aren’t just so Americans can afford a better vacation this year; many Americans need the money to make ends meet. One in three (33 percent) of side hustlers need the income for regular living expenses.

We asked: Which one of the following best describes how you use the extra money you earn from your side hustle?

Why do people need a side hustle? For many, it's not ‘spending money’ but a necessity.

Other reasons for a side hustle include discretionary income for spending (27 percent), income to go into their savings (25 percent) and debt payoff (12 percent).

More women use side hustle income for regular living expenses than men do (37 percent compared to 29 percent). Men, however, tend to use the money for savings more: 29 percent of men use their side hustle income for savings, compared to 21 percent of women.

Lower-income people are also much more likely to use side hustle income for living expenses: 42 percent of those who make under $50,000 a year use the funds for living expenses, compared to only 22 percent of those who make $100,000 a year or more. Those who make $100,000 a year or more are most likely (38 percent) to use side hustle income for discretionary spending.

The tendency to use side hustle income for everyday expenses shows how ongoing inflation is affecting people differently, according to Bankrate Senior Industry Analyst Ted Rossman.

“I’m a big fan of using a side hustle to pay off expensive credit card debt or to boost your savings or investments. A side hustle can also be a great way to pursue an activity or potential career path that you’re interested in,”

Rossman said. “Unfortunately, our research shows that people are much more likely to be pursuing a secondary source of income just to keep their head above water.”

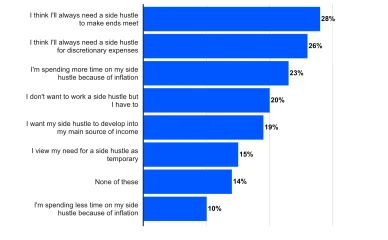

Over 2 in 5 Americans with a side hustle expect to always need one

A side hustle can be a way to explore making your passion a career or utilizing skills that you can’t bring to your 9 to 5. For many people, however, a side hustle is mostly a necessity.

Though 19 percent of U.S. adults told Bankrate they want their side hustle to develop into their main source of income, more than one in four (28 percent) think they’ll always need a side hustle to make ends meet. Another 26 percent of people say they’ll always need a side hustle for discretionary expenses.

We asked: Which, if any, of the following statements do you agree with? Please select all that apply.

The feeling that ‘this is for the long term’: among those who have a side job, 28% believe that they will always need it to make ends meet; another 26% believe that they will always need it for discretionary spending.

The economy is impacting how many people approach a side hustle: Nearly one in four (23 percent) Americans are spending more time on their side hustle because of inflation, while 10 percent of people are actually spending less time on their side hustle because of inflation. Though they didn’t cite inflation, 20 percent of Americans don’t want to work a side hustle at all, but say they have to.

3 ways to utilize extra side hustle income

Two-thirds (67 percent) of side hustlers don’t use the income on day-to-day expenses, freeing that income to be put toward other purposes. If you’re able to choose where to direct extra money from a side hustle, it can be hard to decide where to put it. Here are three options to get you started when you have extra funds at the end of the month:

- Build your emergency savings. An emergency savings account with three to six months of household expenses is an important first step to begin saving for the future. Aside from a typical savings account through the bank you already use, you can put the funds in a high-yield savings account, which allows you to access your money when needed and build more interest than a regular savings account.

- Pay off debt. Paying off debt sooner can free you up to use your main income on what you care about. Consider paying down your smallest debts first, such as in the debt snowball method, or tackling your debt with the highest interest rate first, such as in the debt avalanche method.

- Reward yourself through discretionary spending. That extra work at your side hustle can be even more rewarding when you use the money for yourself and your loved ones. When money is a major stressor for many Americans, a vacation or night out can remind you that life isn’t just about work.