Bank of Ireland

Founded on a strong legacy of over two centuries, the Bank of Ireland (BOI) stands as one of the nation’s most established and trusted financial institutions. As the country’s oldest continuously operating bank, it delivers a comprehensive suite of financial services, including personal banking, business accounts, loans, mortgages, and digital services. As a cornerstone of the national financial landscape, the Bank of Ireland presents itself as a balance of heritage and innovation. Through an extensive network of over 180+ branches and digital platforms, it serves customers nationwide and abroad and is known as one of the Big Four Irish banks.

BOI’s reputation is built on innovation, community focus, and customer-centric services that continue to evolve alongside the Irish economy. This guide explores the bank’s history and growth, digital services, branch operations, card activation procedures, and current offerings to provide a complete picture of its evolution.

Bank Overview

Origins and Growth

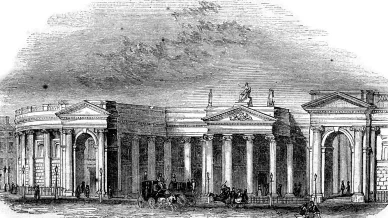

Bank of Ireland headquarters, early 19th century

The Bank of Ireland was established in 1783 with headquarters initially located at Parliament House on College Green, Dublin. Today, its main office is based at Baggot Plaza, in the capital. The bank also has additional operations in the Republic of Ireland, Northern Ireland, Great Britain, and other locations.

As one of the country’s Big Four, BOI has been a central figure in much of Ireland’s economic and social history. With over 240 years of legacy, the financial institution today operates 182 branches across the Republic of Ireland and Northern Ireland, making it a significant component of the island’s branch network.

In 2025, BOI announced a €7 million investment to upgrade 22 of its branches. Among the innovations are plans for new layouts and self-service kiosks. Additionally, the bank continues to roll out new services, including its Smart Start accounts aimed at younger customers and the Home Energy Upgrade Loan Scheme for low-deposit solutions for energy-efficient homes.

As it continues to innovate for customer convenience and modernisation, BOI is committed to preserving its banking heritage.

Shaping the Future of Digital Banking

Bank of Ireland mobile banking app interface displayed on smartphone screen.

The Bank of Ireland uses the latest technology to provide customers with flexible, convenient, and fast banking services. With more people today preferring to manage their money online and independently, the introduction of features such as instant transfers and contactless payments has made it easier to do so.

Among the most popular of its digital offerings is the 365 Online Banking platform and mobile app, delivering most of the bank’s services directly to customers’ smartphones. Features include biometric login, spending insights, and security alerts that offer real-time protection and a modern online banking experience.

Personal Current Account | Bank of Ireland

In 2025, the bankofireland website introduced improved account opening options for returning emigrants and people relocating to Ireland for work or study, called the Coming to Ireland program. With its new measures, customers can now easily set up an account with digital verification, gain early access to their finances, and have a dedicated case manager for support.

Card Management and Activation

Bank of Ireland payment card

How to activate a Bank of Ireland card

Even with all the modernisation of digital finances, debit and credit cards still play a significant role in customer banking. Thankfully, learning how to activate a Bank of Ireland card whether you’re a new or existing customer, is simple. To do so, use one of the following card activation methods:

- Use the card’s chip and PIN during a store purchase.

- Perform a balance enquiry at any ATM.

- Activate the card via online banking or the 365 Online Banking mobile app.

- Contact the bank’s customer service team for help.

You’ll need to enter your PIN the first time you activate your new debit or credit card. To protect yourself from fraud during online or app-based activation, you must use a secure browser and a verified platform.

Customers will find strict security protocols in place, so every process described in the How to Activate a Bank of Ireland Card guide includes multiple verification layers to protect against unauthorised access. Users share responsibility for keeping their banking details and cards secure.

If you’ve forgotten your PIN, log in via the 365 Online Banking app or browser and open 'Cards'. Select the relevant card, tap 'View card PIN,' and make a note of it. It will disappear after ten seconds.

Introducing Money Insights 365

If any problems occur during the card activation process, the support team can provide prompt assistance. Otherwise, the 365 Online Banking app can help with damaged or frozen cards and PIN retrieval.

Card Management Tools

The Bank of Ireland app lets you manage your cards and keep your money safe — all in one place. You can do it yourself, without calling customer service.

Customers can use the 365 Online Banking mobile app or a browser to set spending limits, freeze or unfreeze their cards, adjust contactless payment preferences, and open a new savings account in seconds. For peace of mind, every transaction is monitored with 3D Secure and advanced fraud detection technology. In addition, customers receive instant alerts about any unusual account activity.

Thanks to its integration with Apple Pay and Google Pay, BOI users can make digital wallet payments at home and abroad. While travelling, account holders can manage notifications for safe overseas use and easily request a replacement card if one is lost or damaged.

The BOI website features answers to common questions about credit and debit cards. In this section, users can find up-to-date account information, such as closing an account, adjusting spending limits, checking credit card statements, and finding details on cash advance fees.

Branch Hours and Everyday Services

Bank of Ireland branch storefront with the bank's logo and signage displayed prominently on the exterior.

Current Branch Operations

Although digital banking is becoming more popular, it’s common for customers to ask if Bank of Ireland is open today. However, the answer depends on the branch and location. Most offices are open Monday to Friday from 10:00 a.m. to 4:00 p.m. Currently, only a small number of locations operate on Saturday or Sunday.

During public holidays, branch hours vary. Occasionally, they may adjust their opening times due to local events or seasonal demand. To stay informed, customers can check real-time updates and use the Branch Locator tool on the website to confirm schedules. For urgent banking matters—such as lost or stolen cards or suspected fraud—help is available by calling on 1800 946 764 outside branch hours.

After the COVID-19 pandemic, the financial institution introduced appointment-based services, allowing customers to book visits in advance. As a result, branches reduced waiting times and improved safety for people.

Branch Services Overview

Each Bank of Ireland branch offers various services for personal and business customers. These include self-service options, specialist support, and accessibility features.

Services include the ability to:

- Open new accounts or close existing ones.

- Process mortgage and loan applications.

- Use ATMs and self-service machines.

- Manage card PINs.

- Book financial planning and advisory sessions.

- Make cash deposits and withdrawals.

- Buy or sell foreign currency.

- Learn more about business banking and merchant services.

BOI branches provide a range of facilities to make banking easier and more accessible for visitors: wheelchair access, larger screen ATMs, hearing induction loops, and virtual sign-language interpretation. For those who can’t visit in person, other options such as banking hubs, post offices, and online banking are available, depending on location.

If you have more complex financial needs, an appointment with a financial adviser can help you get tailored guidance. To learn what’s available at your local branch, visit the BOI website for up-to-date details.

Customer Support and Assistance

Interior of Bank of Ireland branch showing customer service area with teller counters, banking desks, and modern facilities.

The Bank of Ireland offers multiple channels of support, making assistance even more accessible. In addition to its online Help Centre, featuring FAQs and a search function, it provides a live chat option for quick resolutions. Currently, customer support features include:

- Phone lines that operate Monday to Friday, 9:00 a.m. – 5:00 p.m., for issues related to personal and business banking.

- 24/7 helpline for fraud reporting and for lost or stolen cards.

- Live chat.

- Secure messaging through the 365 Banking app, with responses sent directly to the app’s mailbox.

- A dedicated Security Zone, providing up-to-date information on banking security and fraud awareness.

Customers can also use the Bankofireland website or the 365 Banking app to submit feedback or complaints. BOI is committed to providing exceptional customer service, and it follows a customer complaints procedure designed to ensure that all cases are handled fairly and professionally. If customers are unhappy with how their complaints were handled, they can contact a representative in person, online, by phone, or in writing.

Recent Updates and Future Plans

Bank of Ireland signage and logo mounted above branch entrance displaying the bank's corporate branding.

Committed to upholding its legacy, Bank of Ireland experienced a year of change in 2025. Through innovation, sustainability, and community investment, the bank’s roadmap focused on technological improvements and responsible growth.

Some of its successful 2025 initiatives include:

- Upgrading 22 branches with modern layouts and self-service kiosks — an investment of around €7m.

- Modernising the ATM fleet and expanding into rural regions.

- Launching dedicated international student banking services.

- Strengthening digital infrastructure to improve and safeguard the user experience.

In addition to environmental initiatives, such as reducing branch emissions and promoting paperless transactions, BOI granted a number of new loans under the Enviroflex and Green Finance schemes for business customers.

After a productive year, the bank plans to continue innovating in finance while helping Ireland transition to a more sustainable financial ecosystem. Its forthcoming 2026-2028 strategy and roadmap will focus on strengthening the bank’s role in society and improving customers’ financial wellbeing.